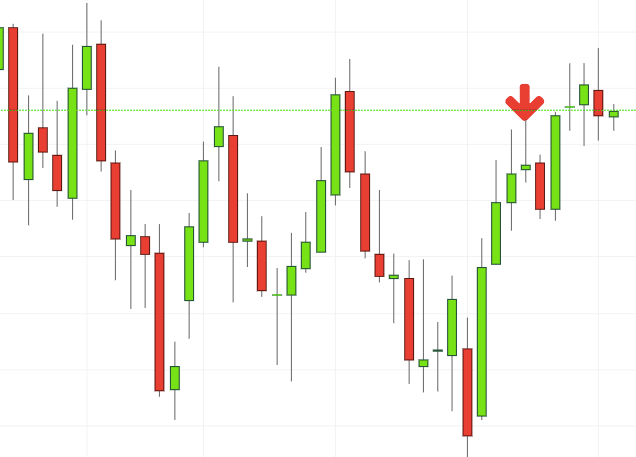

Have you ever wanted to improve your day trading skills quickly? Candlestick patterns can help you make smarter decisions in the market. They offer a visual representation of market trends. When used effectively, these patterns can guide you toward better trades. Let’s dive into actionable tips for using candlestick patterns to achieve trading success.

Identify the Right Patterns

Start by recognizing patterns that align with your trading style. Some are ideal for quick decisions, while others work better for longer trends. For instance, the cup and handle pattern is popular among traders for its reliability and potential for clear signals. Begin with simple patterns before moving to more advanced ones, as this helps build a solid foundation. Practice makes it easier to spot these signals quickly during a live trading session, boosting your confidence and success rate.

Time Your Entries and Exits

Timing is crucial in day trading. Candlestick patterns can guide you on when to enter or exit a trade. Pairing your analysis with external factors like monetary policy changes can improve results by adding a layer of precision to your decisions. For example, a bullish reversal pattern in a stable economy often signals strong entry points, while bearish ones may highlight exit opportunities. Exit strategies should also rely on clear signals to lock in profits and reduce risk while avoiding emotional decision-making. Keeping a sharp focus on timing can significantly enhance your trading efficiency and profitability.

Analyze the Overall Market Context

Patterns work best when combined with a solid understanding of market conditions. Check the overall trend before acting on a candlestick signal. Look at other indicators like volume or momentum for confirmation, as relying on a single pattern can sometimes be misleading. For example, combining it with supportive data ensures accuracy in your trades and reduces the likelihood of errors. Always align your strategy with the broader market movements to maximize the chances of success.

Combine Patterns with Risk Management

Even the best patterns can lead to losses without proper risk management. Always set stop-loss levels when trading based on candlestick signals, as this minimizes potential financial setbacks. This ensures that your losses remain minimal during unexpected market moves, protecting your capital for future trades. Use position sizing to manage your exposure effectively while maintaining a balanced portfolio. A disciplined approach to risk often separates successful traders from the rest and enables you to weather market volatility with confidence. Always prioritize safeguarding your capital, as it is equally crucial as generating profits.

Leverage the Cup and Handle for Reliable Trade Setups

The cup and handle pattern is a favorite among traders for its clear and actionable signals. It can highlight potential entry points and help you gauge market sentiment effectively. Use it alongside other indicators to confirm your strategy. For example, combining it with volume analysis can validate its reliability. By integrating it into your trading plan, you can make well-informed decisions and increase your success rate.

Build Consistency Through Practice

Success in day trading depends on consistent practice. Regularly evaluate your trades to identify what strategies succeeded and where improvements are needed. Journaling your trades based on candlestick patterns can highlight areas for improvement and uncover hidden trading habits. Stay patient and refine your approach with every trading session and current monetary policy, as overconfidence can lead to costly mistakes. Over time, you’ll become more confident in identifying profitable setups and executing trades precisely.

Mastering candlestick patterns takes time, focus, and practice. Using strategies like timing your trades and combining patterns with external data ensures greater success. Tools like trading software can further enhance your effectiveness and confidence in the market. Whether you’re analyzing the cup and handle pattern or focusing on other setups, consistency, and discipline are key. Implement these tips to boost your day trading outcomes confidently and achieve the success you’re aiming for.