Have you been exploring ways to simplify your finances? Managing multiple debts can be overwhelming. Streamlining your repayments into one loan can make life easier. This guide breaks down how to secure a debt consolidation loan. Let’s explore the process together.

Research Loan Options

Take the time to explore various loan types and lenders offering solutions for consolidating debt. Focus on options with competitive interest rates and favourable repayment terms. If you’re considering instant debt consolidation loans, ensure they meet your immediate financial needs and long-term goals. Comparing multiple offers is essential to understanding potential savings and ensuring you pick the right one. Proper research will help you avoid unexpected costs or conditions down the line, giving you confidence in your choice.

Evaluate Your Financial Situation

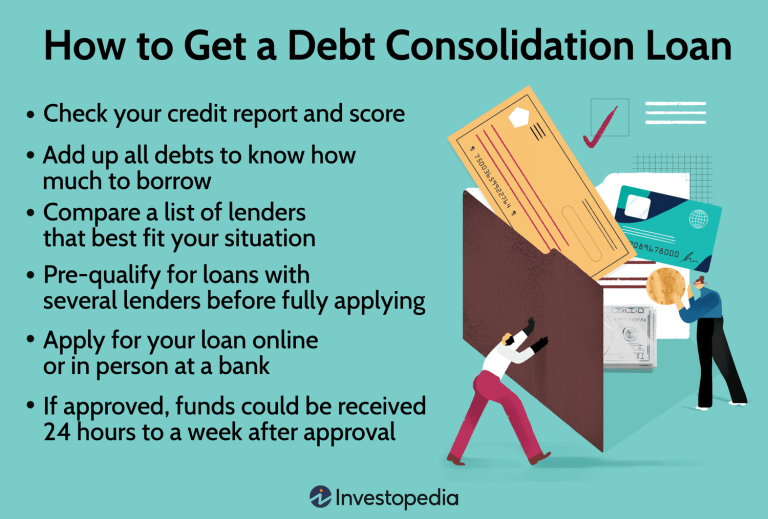

Start by reviewing all your existing debts in detail. List the amounts you owe, the interest rates, and the repayment terms for each. Understanding your financial position is the first step toward finding a better solution. This evaluation helps you determine if consolidating your debts is the right move. It also provides clarity on your repayment capacity, helping you set realistic goals. Knowing exactly where you stand will make it easier to plan your next steps.

Understand the Impact on Your Credit

Before proceeding, consider how a debt consolidation loan might affect your credit profile. Consolidating your debts can simplify repayments, but it’s important to know the impact on your credit score. Making consistent, on-time payments on your new loan can gradually enhance your credit score. However, missing payments could have negative effects. Understanding this aspect will help you make responsible decisions as you move forward.

Check Your Eligibility

After identifying a loan option that suits your needs, take a closer look at its eligibility requirements. Most lenders have specific conditions related to your credit score, income level, and debt-to-income ratio. Ensuring you meet these criteria increases your chances of approval. It’s also a good idea to assess any additional requirements the lender may have. Being prepared with this information allows you to approach the application process confidently and avoid unnecessary setbacks.

Gather Necessary Documents

Prepare all the documents required for your application to save time and reduce stress. These typically include proof of income, recent bank statements, personal identification, and details about your current debts. Double-check that all information is accurate and up to date before submission. Having these documents readily available will not only speed up the process but also demonstrate your reliability to the lender.

Apply for the Loan

Once you’ve finalised your choice, submit your application to the selected lender. Whether applying online or in person, be sure to follow all instructions carefully. Complete the application with accurate and honest information about your financial situation. Transparency builds trust and ensures your application is assessed fairly. After submission, monitor your email or other communication channels for updates from the lender. Staying responsive can help resolve any issues promptly if they arise.

Use the Funds Responsibly

After approval, the loan amount will be disbursed to you, and this is where careful planning is crucial. Use the funds to pay off your existing debts according to your consolidation plan. Avoid using the money for other purposes, as that could defeat the purpose of consolidation. Create a repayment schedule that aligns with your budget and stick to it. Responsible use of these funds can give you a fresh financial start and help you achieve long-term stability.

Getting a debt consolidation loan is a practical step to simplify your finances and reduce stress. By carefully evaluating your situation and researching options, you can make informed choices. If you’re exploring instant debt consolidation loans, take time to find the best fit for your financial needs. Consolidation, combined with responsible habits, can set you on the path toward financial freedom. Begin your journey and regain control of your financial future.