Key Takeaways:

- An efficient payroll setup saves time, reduces errors, and ensures compliance.

- Choosing the right software is crucial for automating payroll processes.

- Gathering accurate employee information is essential for seamless payroll execution.

- Establishing a consistent payroll schedule fosters trust and financial stability.

- Understanding tax compliance and deductions can prevent legal issues.

- Regular testing and reviews enhance the accuracy and efficiency of the payroll system.

- Proper training of payroll staff ensures smooth operations and minimizes errors.

Introduction

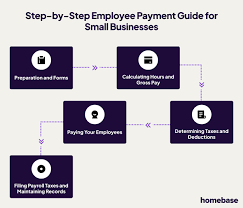

Payroll management is a critical function for any small business. Efficiently managing payroll ensures that employees are paid accurately and on time, essential for maintaining workforce trust and satisfaction. Whether you’re using tools to create paystub online or managing tax compliance, this guide provides a step-by-step approach to setting up an efficient payroll system, helping small business owners streamline their processes, save time, and reduce the risk of errors and non-compliance.

Benefits of Efficient Payroll Setup

Setting up an efficient payroll system offers numerous benefits for small businesses:

- It saves time by automating repetitive tasks and reducing the need for manual calculations. This allows business owners and HR staff to focus on more strategic activities.

- An efficient payroll setup minimizes errors, ensuring employees receive correct wages and benefits. This enhances employee satisfaction and reduces the risk of costly mistakes.

- A well-structured payroll system aids in tax compliance, helping businesses avoid penalties and legal issues.

Choosing the Right Software

Choosing the right payroll software is crucial for automating and streamlining payroll processes. The right software can handle tasks such as calculating wages, processing direct deposits, and managing tax withholdings. When selecting software, consider factors such as ease of use, integration capabilities, and customer support. A user-friendly interface will make it easier for payroll staff to navigate and perform their duties efficiently. Additionally, software that integrates with other business systems, such as accounting and HR, can further streamline operations and improve data accuracy. Invest in a solution that offers robust customer support to help resolve any issues that may arise.

Gathering Employee Information

Accurate employee information is essential for seamless payroll execution. Ensure you collect all necessary details, including personal information, tax forms, and bank account information for direct deposits. Having complete and accurate data from the outset minimizes the risk of errors and delays in payroll processing. Implement a system for regularly updating employee information to reflect changes in tax status, bank details, or personal circumstances. Providing employees with a self-service portal can facilitate this process, allowing them to update their information as needed and reducing the administrative burden on HR staff.

Setting Up a Payroll Schedule

Establishing a consistent payroll schedule is vital for maintaining trust and financial stability within your business. Decide whether your payroll will be processed weekly, bi-weekly, or monthly, and communicate this schedule clearly to your employees. Consistency helps employees plan their finances and builds trust in the organization’s reliability. Use a calendar or payroll software to track critical dates and ensure payroll is processed on time. Regular and predictable pay cycles also aid in managing cash flow, allowing you to better plan for other business expenses.

Ensuring Tax Compliance and Deductions

Tax compliance is a critical aspect of payroll management. Ensure that your business complies with federal, state, and local tax regulations by accurately calculating and withholding taxes from employees’ wages. Properly managing deductions for benefits, retirement plans, and other pre-tax and post-tax contributions is also essential. Staying informed about tax laws and regulations is crucial to maintaining compliance. Review tax guidelines and consult a professional to ensure your payroll processes align with legal requirements. Accurate tax management prevents penalties and builds credibility and trust with employees and regulatory authorities.

Testing and Reviewing Your Payroll System

Before fully implementing your payroll system, conducting thorough testing to identify and resolve any potential issues is essential. Simulate payroll runs to check for errors and inconsistencies, and seek feedback from stakeholders to identify areas for improvement. Regularly reviewing and updating your payroll process helps maintain accuracy and efficiency. Schedule periodic audits to ensure that payroll data is accurate and up-to-date. These reviews can help identify discrepancies, enabling you to make necessary corrections before they become significant problems. Continuous improvement of your payroll system will ensure that it remains effective and reliable in the long term.

Training Your Team

Proper training for payroll staff is essential to ensure smooth operations and minimize errors. Provide comprehensive training on the payroll system, including troubleshooting common issues and staying updated with payroll laws and regulations changes. Ongoing training opportunities, such as workshops and online courses, can help staff stay informed about best practices and new developments in payroll management. Encourage your team to remain proactive in identifying and addressing potential issues within the payroll process. Investing in your staff’s knowledge and skills will ultimately lead to a more efficient and effective payroll system, benefiting the organization.

Fostering open communication can also help staff feel comfortable asking questions and sharing insights. Regularly scheduled training sessions should include real-life scenarios to enhance problem-solving skills. Implementing a mentorship program can also provide newer employees with guidance from experienced team members. Technology such as payroll software tutorials can streamline the learning process. Ultimately, a well-trained payroll team will contribute to improved accuracy and compliance, supporting the organization’s overall success.

Conclusion

Efficient payroll setup is essential for the smooth operation of any small business. By choosing the right software, gathering accurate employee information, establishing a consistent payroll schedule, ensuring tax compliance, testing the system, and providing proper training for your team, you can streamline payroll processes and avoid costly errors. An efficient payroll system saves time, reduces administrative burdens, and enhances employee satisfaction and trust. Invest in setting up a robust payroll system to support your business’s long-term success and growth.