Health is one of the greatest assets an individual can possess. In India, where medical expenses are rising steadily, health insurance has become a necessity. A well-chosen health insurance policy safeguards individuals and families against the financial burden of long-term medical care.

Yet, with the multitude of insurers and plans available, it can be challenging to make a confident choice. This is where comparing insurance policies becomes essential.

When carefully evaluating multiple health policies side by side, one can identify coverage that balances affordability with comprehensive protection. This blog examines the core points of comparing insurance policies in India’s healthcare sector, focusing on its significance, key considerations, and how to make informed decisions for lasting security.

Why Comparing Insurance Policies Matters for Health Cover

Health insurance is not only about meeting immediate medical needs, it is also about ensuring financial resilience over the long term. Policies chosen without careful assessment may appear suitable initially but often prove inadequate when life circumstances change.

For instance, a plan that offers limited coverage during the early years may fall short when chronic conditions or age-related ailments arise.

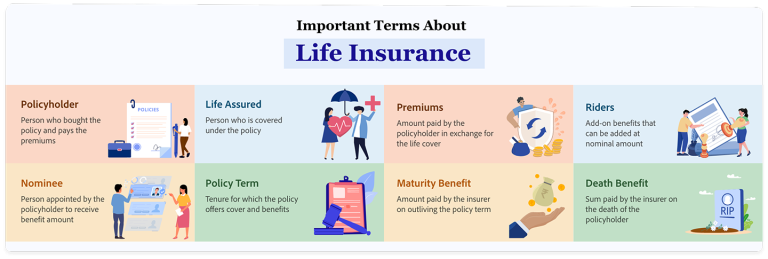

Hence, a systematic insurance policy comparison enables individuals to anticipate such changes by assessing renewal conditions, premium escalation clauses, and long-term benefits. It also highlights policies that allow upgrades or the addition of riders, ensuring continued protection as needs evolve.

From routine consultations to advanced treatments, expenses can quickly empty savings. Health insurance is intended to mitigate this risk, yet no two policies are identical.

Carefully comparing insurance policies ensures:

- Broader protection against varied medical conditions

- Transparency in exclusions and waiting periods

- Access to wider hospital networks and cashless facilities

- Balanced premiums aligned with one’s financial capability

Core Factors to Evaluate in Health Insurance

Before comparing and purchasing health insurance, here are a few factors to consider:

-

Premiums and Affordability

The cost of a health policy is often the first factor considered when evaluating health insurance options. However, a lower premium should not be mistaken for better value. An effective insurance policy comparison considers premium costs along with renewal terms, sub-limits, and co-payment clauses. Balancing affordability with adequate coverage ensures long-term sustainability.

-

Coverage Benefits

Coverage scope is the most essential part of a health plan. Policies may differ significantly in what they include, such as day-care procedures, pre- and post-hospitalisation costs, and critical illness riders. Comparing insurance policies highlights these differences, ensuring that the chosen policy aligns with medical realities faced by individuals and families.

-

Exclusions and Waiting Periods

Exclusions limit the benefits of health insurance. Common exclusions include pre-existing diseases for an initial period, cosmetic treatments, or injuries arising from hazardous activities. Similarly, waiting periods for maternity benefits or specific illnesses vary across policies.

- Hospital Network and Cashless Access

Having access to a wide hospital network ensures convenience during emergencies. Cashless hospitalisation facilities reduce immediate out-of-pocket expenses. An insurance policy comparison reveals which insurers offer broader networks, enabling smoother experiences during treatment.

-

Claim Settlement Ratio and Process

The ability of an insurer to honour claims promptly is critical. The claim settlement ratio indicates the percentage of claims that are successfully processed and settled. A strong record should weigh heavily in any insurance policy comparison, as it indicates reliability during times of medical distress.

Comparing Insurance Policies Across Life Stages

Another important thing to consider before purchasing a health insurance policy is the age group you fall into. Individuals across different life stages need to evaluate and compare insurance plans equally to gain the full benefit. Here are a few things to keep in mind:

-

Young Professionals

For those starting their careers, affordability and preventive coverage are the most important considerations. A comparison of policies with lower premiums but sufficient hospitalisation cover ensures security without overburdening income.

-

Families with Dependants

Here, the priority is comprehensive coverage. Family floater policies that cover spouses, children, and sometimes parents are suitable. An insurance policy comparison identifies policies that offer broader coverage for dependents at reasonable rates.

-

Senior Citizens

Older individuals face higher medical risks. Policies with minimal waiting periods, higher sum insured, and wide hospital networks are essential. Thus, conducting a structured insurance policy comparison highlights insurers that cater effectively to this age group.

Common Mistakes to Avoid During Health Insurance Comparison

Often, individuals make the mistake of choosing the wrong health insurance, which results in incomplete coverage. Here are a few common mistakes to avoid when purchasing health insurance:

- Focusing Only on Premium Costs: Cheaper policies often come with restrictive conditions.

- Overlooking Sub-limits: Ignoring caps on room rent or specific treatments can lead to out-of-pocket expenses.

- Not Reviewing Waiting Periods: Certain benefits may not be accessible when needed most.

- Ignoring Portability Options: The ability to switch insurers without losing benefits is important.

- Choosing without Professional Guidance: Expert advice can clarify complex clauses.

The Role of Digital Tools and Brokers in Health Policy Comparison

The Indian market offers digital platforms that simplify the process of comparing multiple policies simultaneously. These tools provide side-by-side comparisons of premiums, coverage, exclusions, and riders, helping customers make informed decisions quickly.

However, digital tools are complemented by the expertise of licensed brokers, who interpret terms and ensure the policyholder understands the implications of fine print. Brokers also assist during claims, adding practical value beyond simple comparison. A combination of digital tools and expert guidance makes comparing insurance policies more reliable.

For those ready to take the next step, turning to trusted partners can simplify the process. Online Insurance Brokers such as Jio Insurance Broking Ltd combine expertise with digital solutions to help individuals compare and secure health insurance policies that truly safeguard their future.